How to Remain Consistently Profitable in Forex by Applying Proper Risk Management.

Is your trading account hurting? Do you feel overwhelmed, frustrated and ready to throw in the towel on the whole “trading thing”?

Well, today’s lesson, if properly understood and implemented, can quite possibly provide you with the knowledge that you need to literally save your trading account and start building it back up.

You’ve probably heard that about 90% of people who trade or “speculate” in the markets, end up failing over the long-run. Whilst there can be a multitude of reasons for this mass failure, the primary one that underlies all the other ones is typically poor or no risk management skills. Often, traders don’t even understand risk management and just how important and powerful it is.

“Never Start a ‘War’ You Aren’t Prepared to Win.”

There are three essential aspects to trading success, especially for beginners:

✅ Technical Ability: This is chart-reading, price action trading, geometrical patterns identification or whatever trading strategy you choose (I use and teach price action and pattern identification strategies for a variety of reasons).

✅ Money Management: This is “capital preservation” and it encompasses things like; how much $ will you risk per trade, position sizing, stop loss placement and profit targets.

✅Then, there is the mental side, or trading psychology

All three of these things, technical, money management and mental, are interconnected and intertwined in such a way that if one is missing, the other two essentially mean nothing.

Today however, we are focusing on money management obviously, and honestly if you ask me, I would say that money management is the MOST important of the 3 pieces discussed above.

Why?

Simple: if you aren’t focusing on money management enough and taking care of it properly, your mindset is going to be wrong and whatever technical chart reading ability you have is essentially useless without the Money and Mind pieces in place.

Therefore, before you start trading with your real, hard-earned money, you have to ask yourself one question: are you starting a trading ‘war’ that you really aren’t prepared to win? This is what most traders do, and most traders lose.(I expand upon this concept in my complete training programs).

Never Leave the Castle Unprotected!

Of what good will it be for an entire army to ride out into a war and leave the castle with all its riches (gold, silver, civilians) unprotected and unguarded? That’s why there is always a defense in place.

So why go into the battle of trading without first defending your money?!

You protect and pro-long and GROW YOUR TRADING ACCOUNT by defending it FIRST. THEN, you go and execute potential winning trades. Remember, “rules of engagement 101 for trading”: NEVER leave your bank account unprotected when you go out to fight the “battle” of trading. Now, what exactly does that mean to you as a trader and more importantly, how do you do it?

It means, you do not start trading live, with real money, until you have a comprehensive trading plan in place. Your trading plan should detail things like what is your risk per trade? What amount of money are you comfortable with potentially losing on any given trade? What is your trading edge and what should you need to see on the charts before you pull the trigger on a trade? Of course, there is a lot more to a trading plan, but these are some of the most important pieces. (I provide explanation of trading plans, with a template to help you build your personalized plan on chapter 9 and 10 of my book Ultimate Forex Trading Blueprint).

I never go into the “battle of trading” unless I believe I have a strong chance of winning (high probability trade set up), but I also always assume I COULD LOSE (because any trade can lose) so I ensure my defense is set in place whenever I trade.

WHY RISK MANAGEMENT IS SO POWERFUL AND HOW TO USE IT

What is the key to making consistent money in the markets over time so that you can actually make a living trading? It’s simple; stay in the market long enough to let your edge play out in your favor. However, most traders blow out their accounts before this can happen, due to poor capital management skills. Hopefully, you will learn to remedy this situation for yourself.

Here is how you make money as a trader:

✅Contain all your losses below a certain percentage of your account balance, which you have pre-determined as your personal risk amount that you are OK with losing on any given trade.

✅Trade your edge properly and let it play out over time so that you have some bigger winners in between your smaller losers.

Honestly, that about sums it up. But most traders over-complicate the whole thing and shoot themselves in the foot over and over until they have no money left.

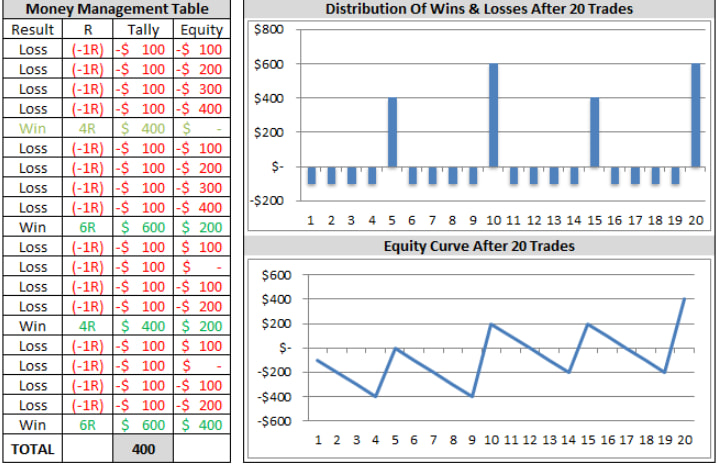

Now, see the image below. I want you to study and understand it, then IMPLEMENT IT IMMEDIATELY in your trading.

What the images above are showing is that:

✅Winning percentage is not that important. In the example below, the win rate is about 20% and the trader still made money!

How? Properly managing risk capital. Notice how all the losses are the same amount but some of the winners are 4R or 6R? This is what a winning trading performance looks like. It’s also fine to have some 2R winners mixed in as well.

✅You need to have a mental obsession with capital preservation. You have your maximum 1R dollar risk amount and then you have to decide how much money you want to risk on any trade at that 1R max OR LESS, but you NEVER go over it. You will see in the image below the 1R max was $100 per trade.

✅Yes, there were more losses than wins, by quite a bit, but because the capital management / preservation was SO consistent and disciplined, the winners more than took care of the losers.

I hope this example serves as a wake up call to those who don’t practice disciplined capital preservation. Study these example well, then go and begin practicing it in the real world.

Access a complete Risk and Money Management Training to Help You Boost Your Trading Results today!